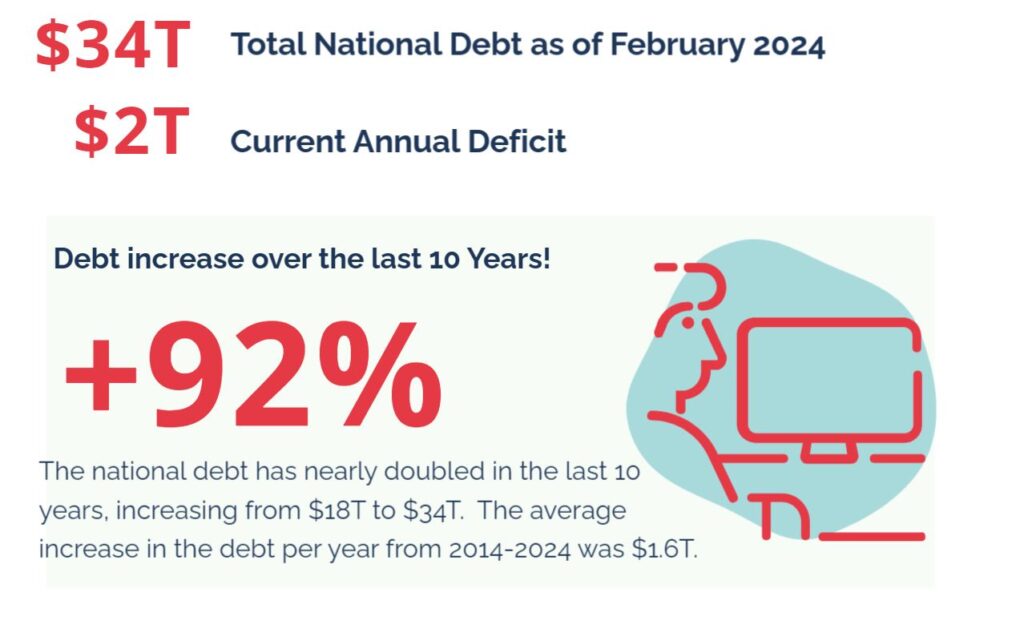

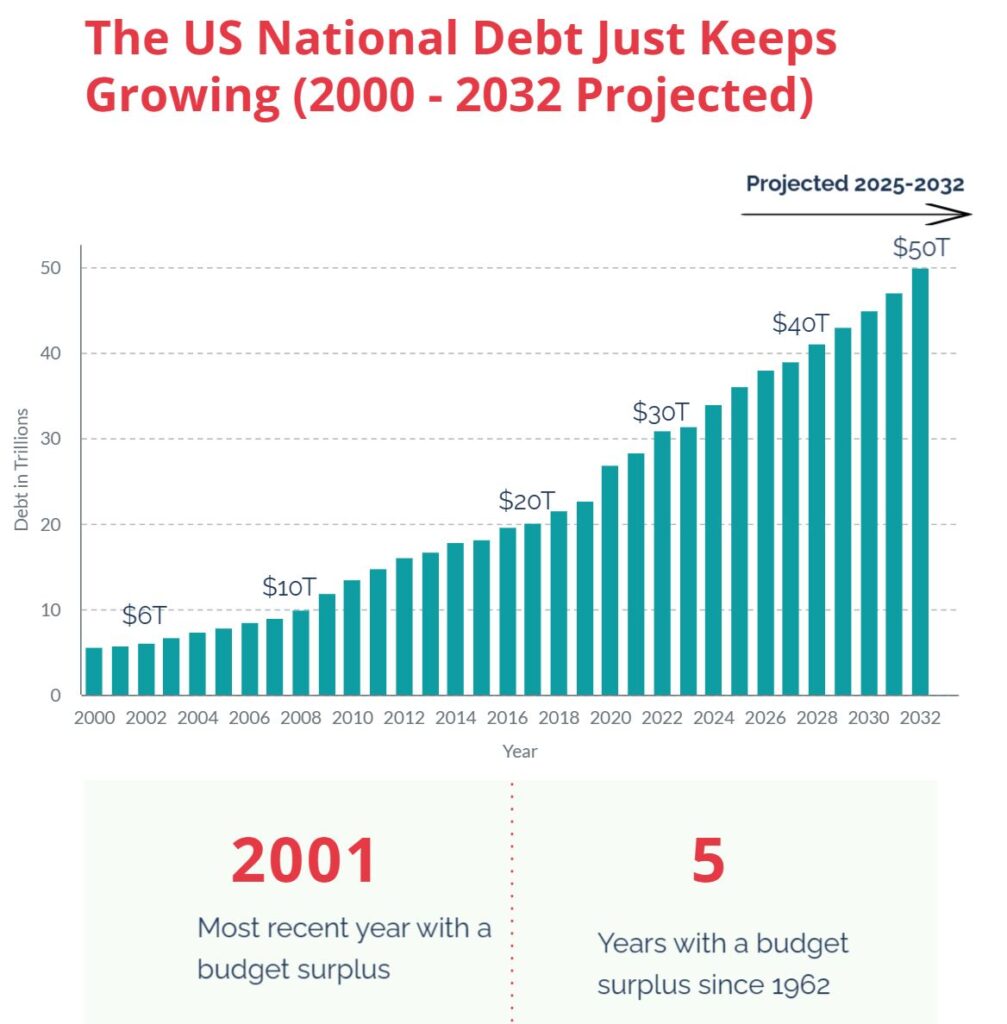

In this age of extreme political divisiveness, one issue that gets far too little attention is our country’s significant national debt levels. The national debt has risen dramatically in recent years due to challenges related to the pandemic and the lack of willingness by politicians in both major parties to face financial realities.

Conclusion

Improving the country’s financial position will take a multi-faceted and disciplined approach.

A few likely changes that I would expect to see over time to help address the debt situation include:

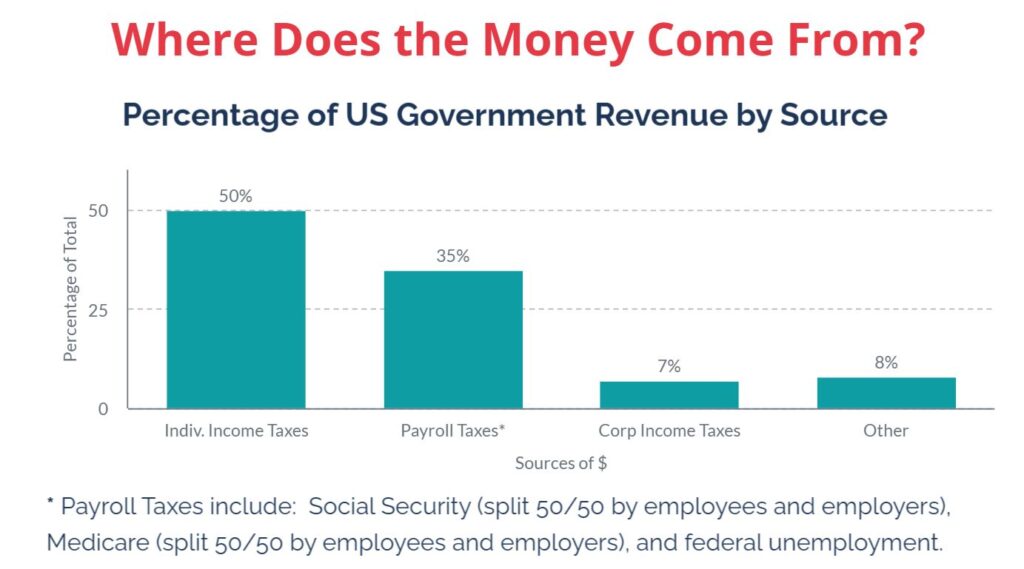

- Higher corporate tax rates and/or elimination of loopholes that enable companies to avoid paying their share.

- Increased capital gains taxes (targets wealthy Americans).

- Increased income tax rates for wealthy Americans.

- Reduction in the estate tax threshold. The current estate tax only comes into play for assets above $13.6 million for an individual or $27.2 million for a married couple.

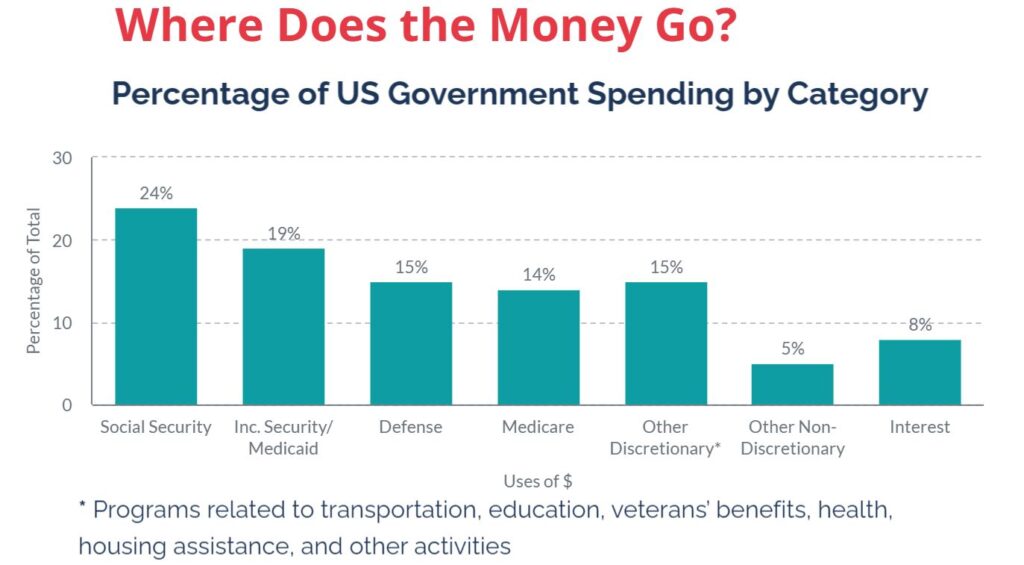

- Reform of federal programs (Social Security, Medicare, etc.) to cut back on benefits over time and eliminate waste/fraud.